A company’s fleet is an invaluable asset, but it’s also—by its very nature—more vulnerable to liability claims.

According to Safe Work Australia, vehicle crashes are the largest contributors to work-related injuries and fatalities. Apart from the physical and emotional pain a serious accident could cause, a fleet’s daily exposure to road traffic can leave your business vulnerable to expensive claims for injury or damages. And no one needs those.

For one, the stress of dealing with court cases can seriously impact your operations. Second, if your employees think they’re at risk, morale will be low. And third—a liability lawsuit can deal a heavy blow to a company’s finances and reputation, regardless of the outcome.

Fortunately, there are steps you can take to proactively reduce your fleet’s liability exposure and lower the chances of facing a legal challenge. To do this, you need to understand what liability is, so you can identify vulnerabilities within your fleet and take corrective action. And that’s exactly what we’re going to discuss.

What does liability mean?

The term ‘liability’ most commonly refers to the legal responsibility for someone’s actions or inactions causing harm to oneself or others.

For example, if a person is injured in an accident, they may accuse another person of being liable for their injury and seek financial compensation in a court of law. There, they will need to demonstrate that the accused was negligent—that is, that the accused had a legal duty to take all reasonable care to avoid causing harm, and that it was their failure to fulfil this duty that caused said harm.

There are varying types and degrees of liability, and more people may be held liable for one person’s negligence. In a business context, for instance, the Work Health and Safety Act assigns various legal duties to employers, managers, and workers for protecting themselves and the public from any risk associated with the work.

As a fleet-owning business, you will inevitably face some degree of exposure—so it’s vital that you make safety and compliance a top priority. This will make it difficult for a judge to say you or your staff have been negligent in the event of a liability claim.

What does negligence look like?

Negligence comes in many shapes and forms. Here are some examples a fleet could face:

- When a company allows an employee or independent contractor to drive a vehicle, even though they are deemed unfit (negligent entrustment).

- When a company fails to do adequate research into hiring practices and potential employees (negligent hiring).

- When a company fails to dismiss an employee who has acted negligently—such as retaining a driver who has been known for DUI offences (negligent retention).

- When a company does not provide employees with proper training on how to handle certain situations with specific vehicles (negligent training).

- When a company does not ensure the workspace (including the vehicle itself) is a safe place to work in accordance with work health & safety laws (negligent management).

More Factors That Lead to Increased Exposure for Fleets:

- Size of the fleet—the more vehicles you have out on the road, the higher the exposure

- Insufficient budget for repairs or maintenance, meaning a higher risk of malfunctions

- Age of the fleet—older vehicles may lead to poorer safety records than newer vehicles

How can I reduce liability exposure?

Here are tips to help reduce risk exposure in your fleet:

1. Stay on Top of Vehicle Maintenance

One of the key steps to reducing liability exposure is conducting regular vehicle inspections.

By proactively keeping your vehicles in great shape and addressing problems before they become dangerous (and expensive), you’re helping minimise the risk of accidents due to a vehicle malfunction.

Since preventative maintenance costs very little compared to repairs (which are usually passed onto customers via higher rates), you’ll also be keeping maintenance costs to a minimum—without discounting fleet safety.

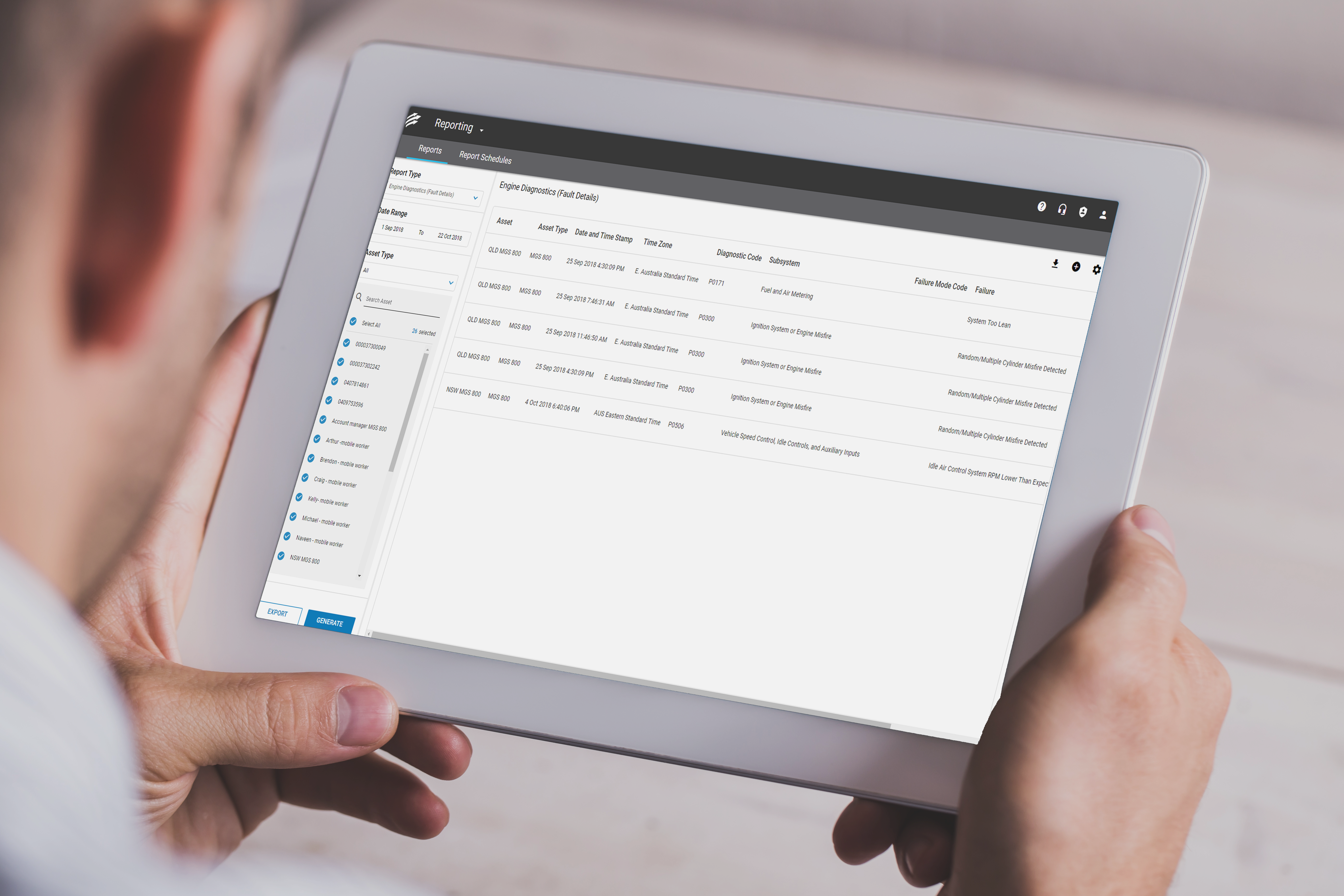

Fleet Complete’s engine diagnostics hub lets you spot maintenance issues before they become a liability.

2. Monitor Driver Behaviour

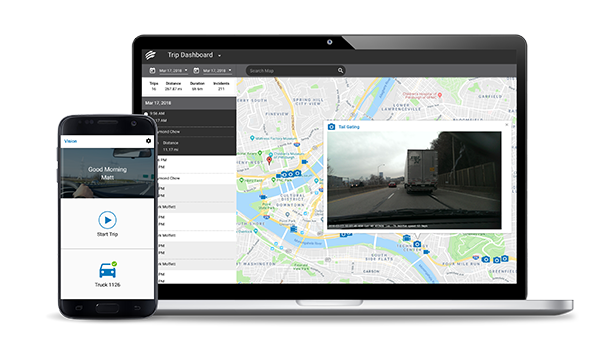

Make sure your drivers are trained properly on how to drive safely, improve their skills, and stay compliant. Also, remember that training isn’t a one-off event: invest in fleet management software to monitor and track your drivers’ performance so you can quickly spot and address unsafe driving patterns like harsh braking, speeding, rapid acceleration, tailgating, and more.

Be sure to maintain detailed records of all training sessions or workshops conducted by any outside sources. Any courses/workshops/seminars that are given by your company employees should also be documented for reference purposes. These records will be needed if you are questioned about safety procedures or how your staff is trained to handle specific vehicles.

3. Leverage Technology to Improve Safety

Fleet management software can go a long way towards helping ensure your fleet and drivers are compliant.

For instance, it makes it easy for managers to ensure drivers adhere to scheduled hours, in compliance with safety standards. This includes making sure that drivers take regular breaks: tired drivers are dangerous drivers.

Australia’s worst crashes tend to be caused by one or more of these six reasons (Image Source)

Australia’s worst crashes tend to be caused by one or more of these six reasons (Image Source)

Why having a fleet management program is essential

Fleet safety is paramount—not just for businesses, but for drivers and their families. With the right policies in place, fleets can do what they do best—driving solutions for customers—while minimising liability exposure.

A fleet management solution can help mitigate risk exposure by allowing you to:

- Establish and nurture a company-wide culture of safety

- Ensure and track compliance with regulations and laws

- Identify problem areas before they become liabilities

- Improve safety policies using the latest technology

- Track key safety metrics and readjust your goals

- Incentivise good performance and improve training programs

If you do face a legal challenge, fleet management software may help you demonstrate that you’ve taken all reasonable care to fulfil your legal duties. Having all your data in place through detailed reporting can act as a record of good practices around driver safety and accountability, and can help you look good in the event of litigation.

If you’d like to see how fleet management software can help protect your business, take our fleet management system for a spin. Get started today by trying our Fleet Complete demo.

If you found this article helpful, please share it on social media.

Please note: the content of this article is for informational purposes only. It does not, and is not intended to, constitute legal advice. If you are facing a liability claim, you should seek professional legal advice.