Asset theft is a nightmare to deal with. Be it your vehicles, equipment, or cargo that’s stolen, you’re looking at significant downtime, delays, and money loss. Not to mention all the back and forth with authorities, insurance companies, and unhappy customers or suppliers.

Of course, you never know when thieves may strike. But if they do, having a strong contingency plan in place will help prevent a disruption from turning into downright disaster. That’s why so many companies today are making this a priority.

In this article, we’ll talk about five key components of a comprehensive asset protection plan—but first, a few more words on why you need one.

How Likely Is Asset Theft?

Virtually everything that has value for your business can be considered an asset—from office furniture and equipment to the company’s vehicles. But some of these assets are more valuable to thieves and more susceptible to being stolen or damaged.

According to the National Motor Vehicle Theft Reduction Council (NMVTRC), a passenger car or light commercial vehicle is stolen every 13 minutes in Australia. That’s reason enough to be vigilant: even one incident could be devastating for your business.

The COVID pandemic—and consequent logistical disruption at ports and warehouses—also compounded the risks. “The effects throughout 2020 of the COVID crisis threatened supply chain security, continuity and resilience,” says Mike Yarwood, managing director of loss prevention at logistics insurer TT Club.

Simply put, the stockpiling of goods at warehouses and production facilities put a strain on security systems and created new targets for thieves. In fact, theft from warehouses and other storage facilities increased to 25% of total thefts.

What Are the Benefits of Having an Asset Protection Plan?

Asset protection planning is crucial for businesses that can’t afford to have expensive assets stolen or damaged. When done right—there’s no room for half-measures here—it ensures your assets are not only properly accounted for and protected at all times, but it also provides a blueprint for swift damage control in the event of emergency.

Creating an asset protection plan helps you to:

- Reduce the likelihood of asset theft

- Quickly and easily identify missing items

- Know who needs to do what if an incident occurs

- Increase the chances of recovering stolen assets

- Minimise downtime and overcome setbacks quickly

- Improve overall business efficiency and productivity

How to Create an Asset Protection Plan

Here are five fundamental steps to putting together a solid asset protection plan:

1. Identify Critical Equipment and Vehicles

First and foremost, identify the assets you want to protect. List the kinds of equipment and vehicles that make up your fleet; which ones are of most value to your business? What types of equipment have a high resale value and could be most attractive to thieves?

With that in mind, it’s time to take inventory. Create digital copies of all relevant documents—proof-of-purchase, serial numbers, warranties, loan repayments, vehicle registrations—and store them together with pictures or videos of your assets. Don’t forget to create backups for extra safety.

2. Do a Background Check on Company Hires

Most companies know and trust their staff to do their jobs with integrity, but you still could face an unlikely situation where an employee might steal a vehicle or equipment. Conducting background checks makes sense if you want to ensure that the people you hire are reliable, especially if they have easy access to critical assets.

If you don’t feel comfortable running background checks yourself, there are companies that offer this service for just a small fee.

3. Establish Accountability Measures and Communication Lines

To keep a firm grip on your assets and vehicles, you need to know where they are and who is responsible for them at all times. You also need a clear communication plan so that both you and your team know exactly what to do and who to call if anything goes missing.

In the event of a break-in or theft, the faster and more methodical your team’s reaction, the greater your chances of recovering the stolen goods. Police departments and insurance companies will only investigate a claim of stolen property if a formal police report is filed. So being ready to procure all the necessary paperwork can significantly speed up the investigation process. It’s also important that the right people are prepared and available to help investigators with every bit of information required.

If the situation is affecting customers or suppliers, having a clear process for informing them of delays or offering backup plans to accommodate them, will help keep those relationships positive and minimize any damage to your reputation.

4. Know Your Insurance Policy

Insurance is one of the most important parts of running a business, but it can also be the most confusing in the event of a claim.

Just as important as choosing the right coverage for your needs and paying your premiums on time so that your protection goes uninterrupted, is being familiar with your insurance arrangements and knowing what your policy does and does not cover. You may have multiple policies and, depending on the event, some benefits may kick in simultaneously while others may be mutually exclusive. As part of your asset protection plan framework, develop an understanding of how insurance policies interact with each other so you can maximise your payouts.

Keep all your policies together in a safe place and have a list of policy numbers, coverage types and contact details on hand for quick reference. If an incident occurs that might give rise to a claim, inform your insurer(s) immediately even if you aren’t ready to claim yet.

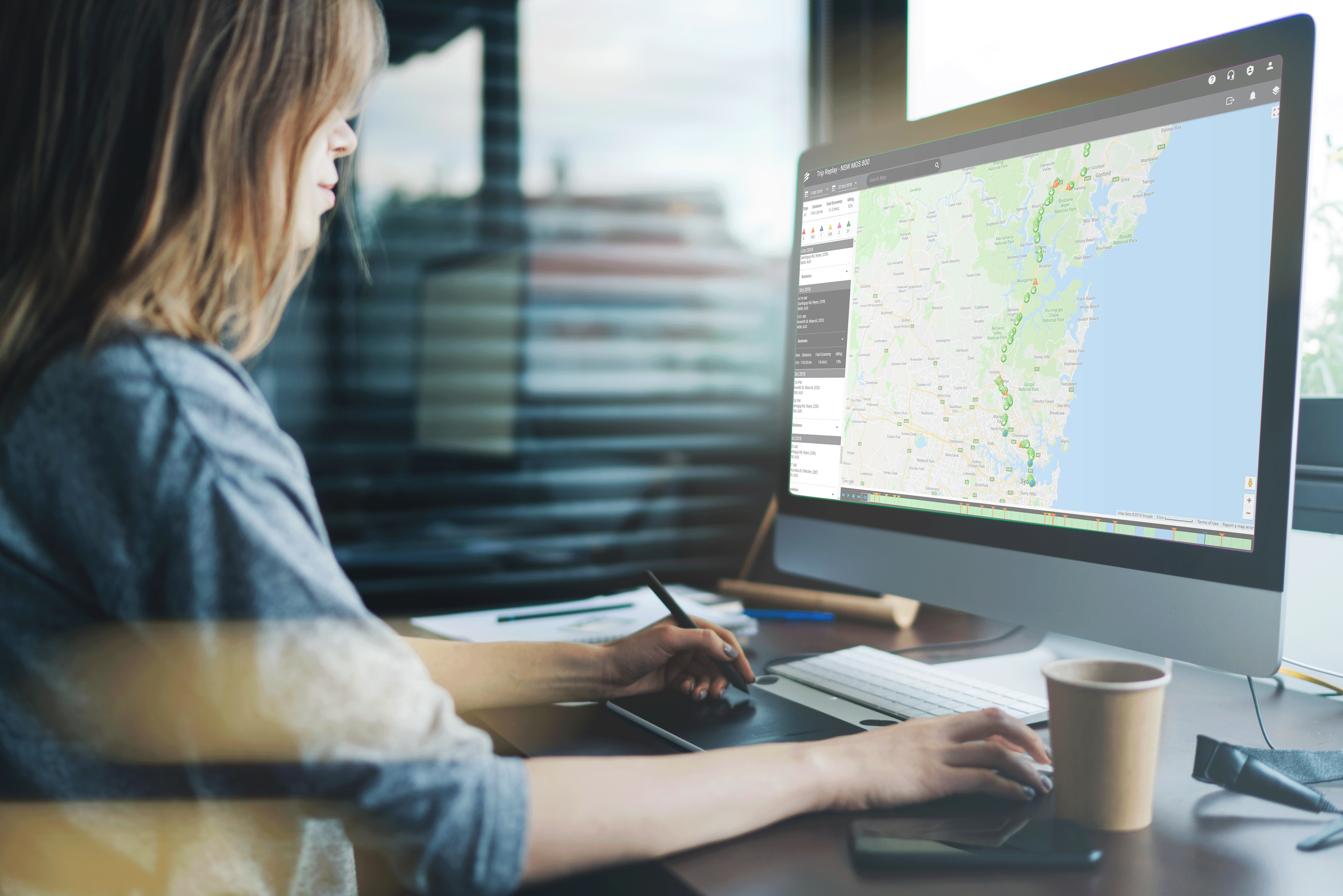

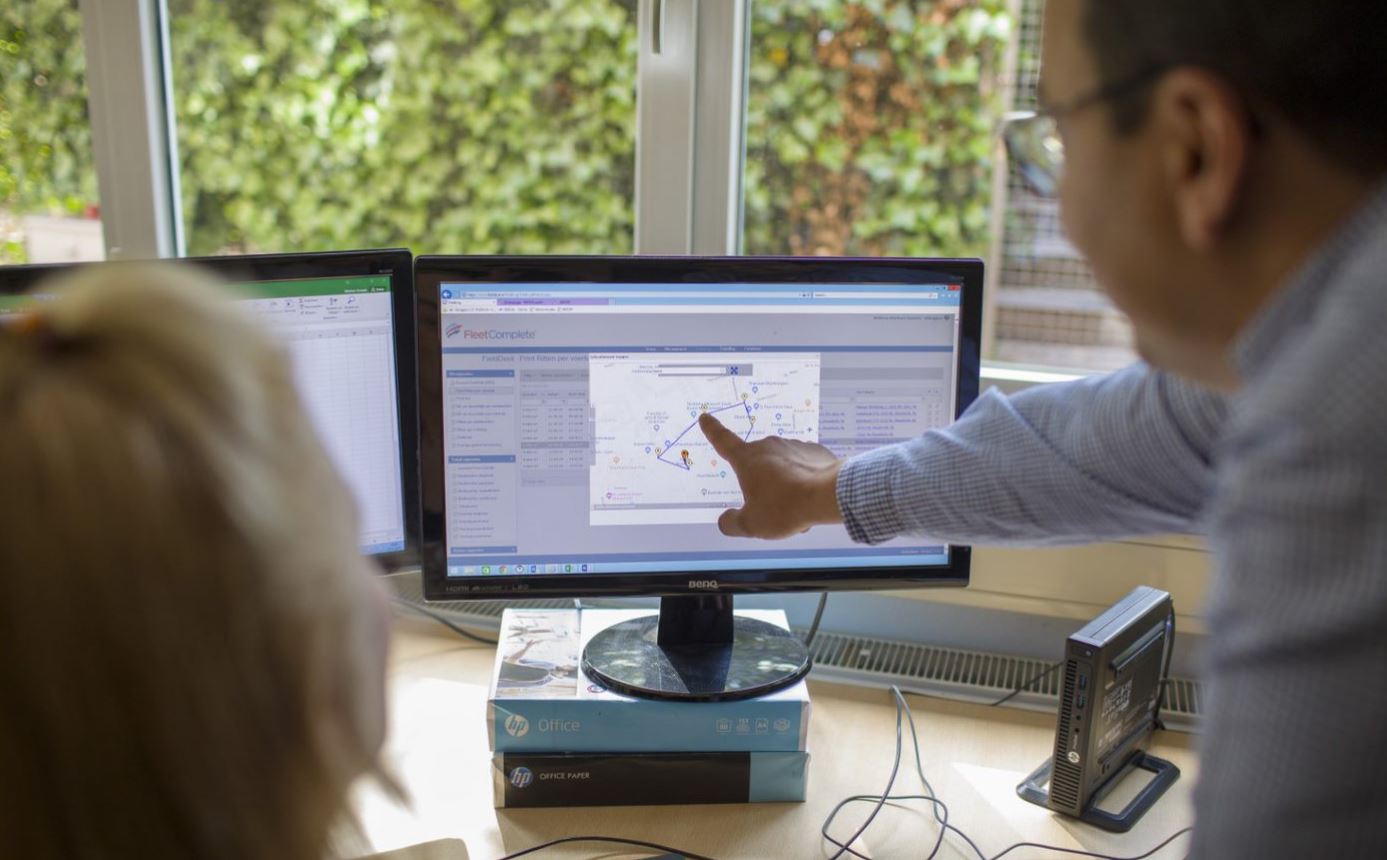

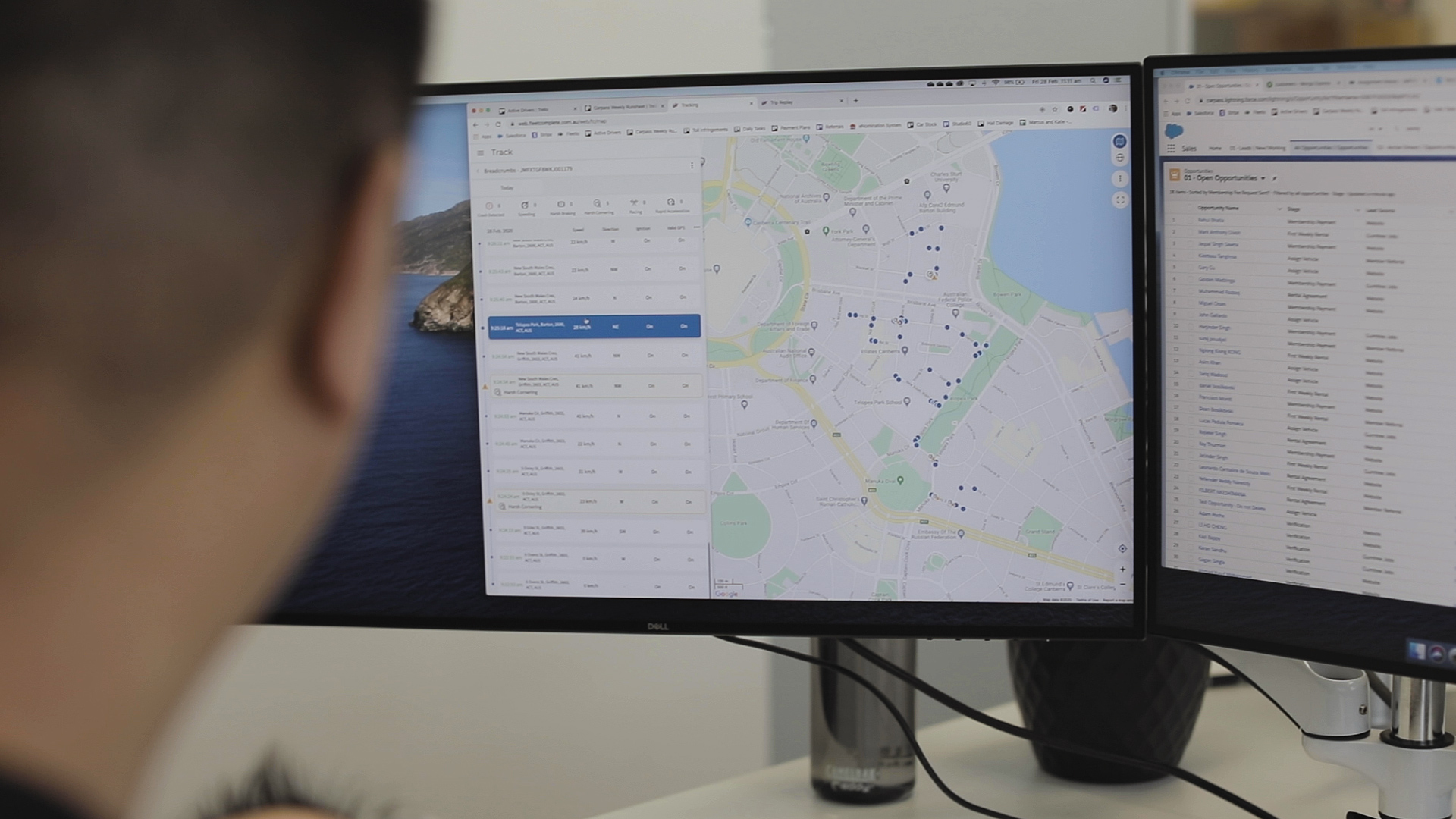

5. Use GPS Tracking Software

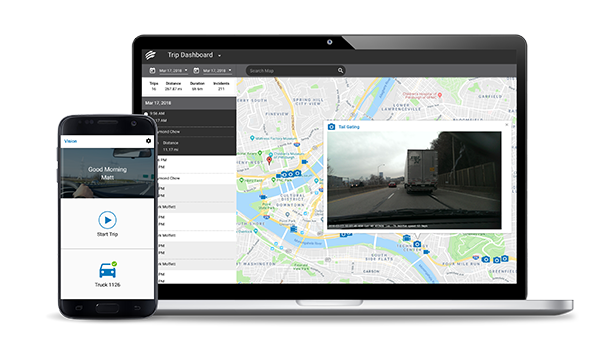

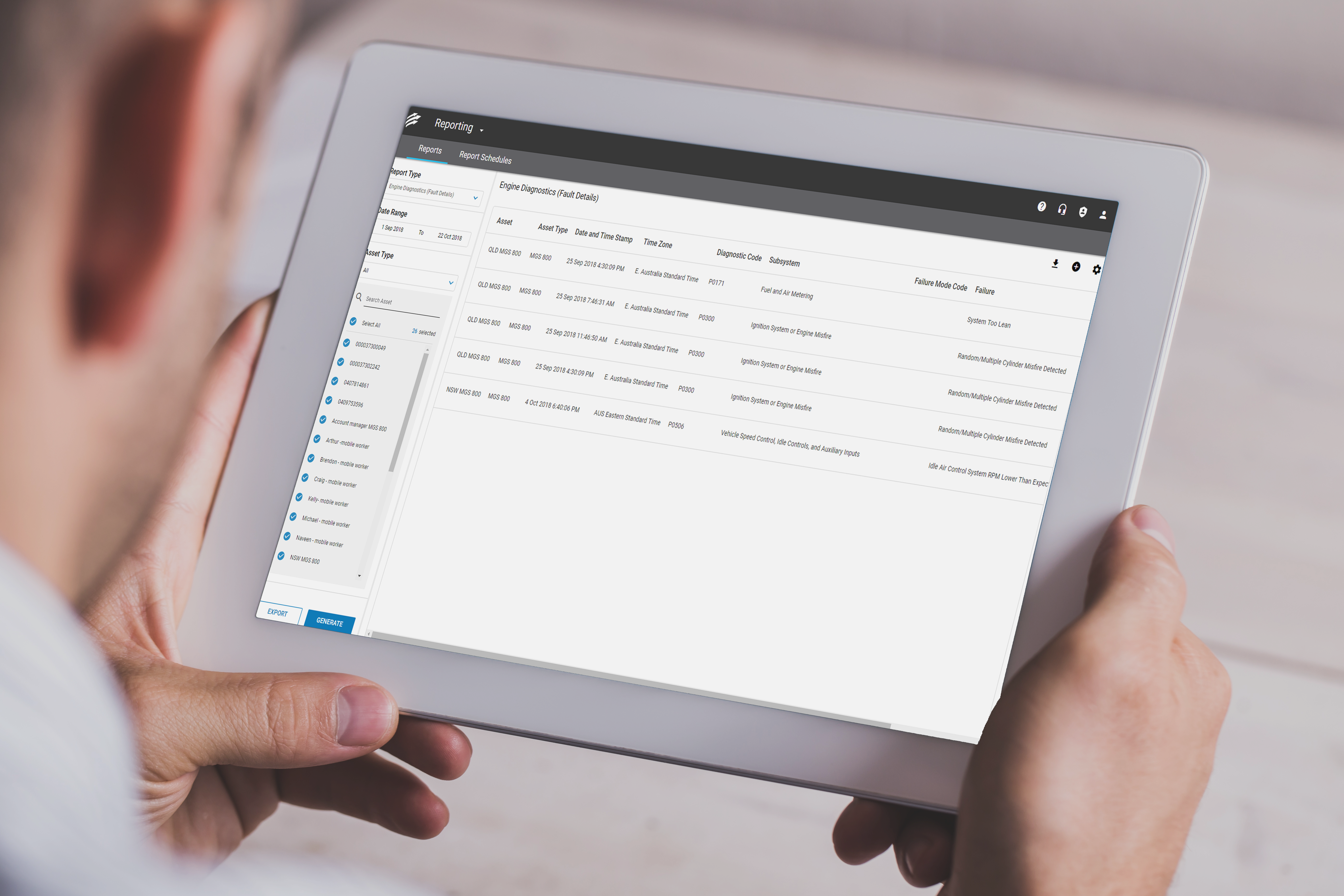

Using GPS fleet management and asset tracking solutions allows you to monitor and keep track of your vehicles, equipment, and cargo at any given time—and it’s the best way to prevent the theft of these valuable items in the first place, or get them back quickly if someone does steal them.

For instance, if one of your vehicles goes off-site without authorisation, this can be an early warning sign that something suspicious is occurring. By setting up geofencing and alerts, you can be immediately notified when a vehicle is no longer on its planned route or when a valuable piece of equipment is moved outside the designated area.

If you haven’t made GPS fleet management part of your business plan, here are some points that might convince you it’s time.

Fleet management software helps protect your business by:

- Monitoring unauthorised vehicle use during non-working hours

- Keeping everything connected even in remote or isolated areas

- Providing accurate, real-time data and event history in case of an incident

- Warning managers when vehicles move out of area, or into unauthorised locations

- Preventing theft by disabling engines or tracking vehicles taken without permission

- Ensuring compliance with labour regulations by tracking working hours, night work, etc.

- Helping secure insurance discounts for regulatory compliance or safer driving

- And much more!

Take our fleet and asset management systems for a spin to see how they can help you optimise your fleet and asset security. Get started today by trying our Fleet Complete demo.

If you found this article helpful, please share it on social media.