When it comes to fuel tax credit (FTC) claims, it’s important to be prepared and follow the required steps when filing your taxes. While the possibility of getting audited is relatively low (approximately 2 million taxpayers every year), getting a letter or call from the Australian Taxation Office (ATO) can set anyone into a panic. You certainly don’t want to miss out on any potential fuel tax rebates that could save your business money either. That’s why, to help you out, we’ve put together a guide on how you can simplify FTC claims.

1. The Basics: What is a Fuel Tax Credit Claim?

According to the ATO, fuel tax credits give businesses a reimbursement for the fuel tax that was included in the fuel price (excise or customs duty) used in equipment, machinery, plant, weighty vehicles and light vehicles, travelling off public or on private roads. The credit amount depends on when you acquire the fuel, what fuel you use, and the activity you use it in.

A fuel tax credit claim is a refund given to businesses for the excise paid on taxable fuel. Businesses will need to claim the fuel tax credits (FTC) through the FTC process before getting the refund.

2. Who is Eligible for the Claim?

When it comes to eligibility, there are four questions every business owner should ask.

-

Am I an eligible business?

According to the ATO, you need to be registered for Goods and Services Tax (GST) and FTC. You can claim your FTC on your Business Activity Statement (BAS). While claiming FTC is optional, most businesses (other than light vehicles travelling on public roads and aircraft) are entitled to FTC. The amount of FTC you can claim depends on the type of fuel you use, when you acquired it, and how you use it.

-

Am I using eligible fuel?

The ATO states that you can claim fuel tax credits for any taxable fuel that you’ve acquired, manufactured or imported to use in your business. Examples of taxable fuels include diesel, petrol, kerosene, heating oil, toluene, fuel oil, transport liquefied petroleum gas (LPG), transport liquefied natural gas (LNG) and transport compressed natural gas (CNG).

-

Am I doing eligible activities?

Your business can claim fuel tax credits if you’re using the fuel in road transport. The ATO noted that eligible vehicles must have more than 4.5 tonnes of gross vehicle mass (GVM) and be travelling on public roads. If they’re diesel vehicles, these vehicles had to have been acquired before 1 July 2006, with a GVM equal or greater than 4.5 tonnes, travelling on public roads.

You can also claim FTC for the fuel you use for other business uses like agriculture, fishing, forestry, mining, construction, manufacturing, among others, and if you use the fuel for packaging or supplying fuel.

-

What activities and fuels are not eligible?

According to the ATO, activities that are not eligible include fuels used in light vehicles with a GVM of 4.5 tonnes or less on public roads, gaseous fuels used in heavy vehicles for travelling on public roads, aviation fuels, some alternative fuels (ethanol or biodiesel) and fuel you acquired but has not used due to loss or theft.

3. How to Simplify Fuel Tax Credit Claims

Darryl Daisley, a Director with the Pitcher Partners Taxation Services Team, noted that “The Federal fuel scheme covers tens of thousands of businesses, from small councils moving verge lawns and reserves all the way up to the BHPs of the world…The problem is that it is increasingly complex to claim correctly…The issues for many businesses is that the rate changes that now occur twice a year and you must apply under the correct rate. It adds to the layers of complexity around claiming on your fuel.”

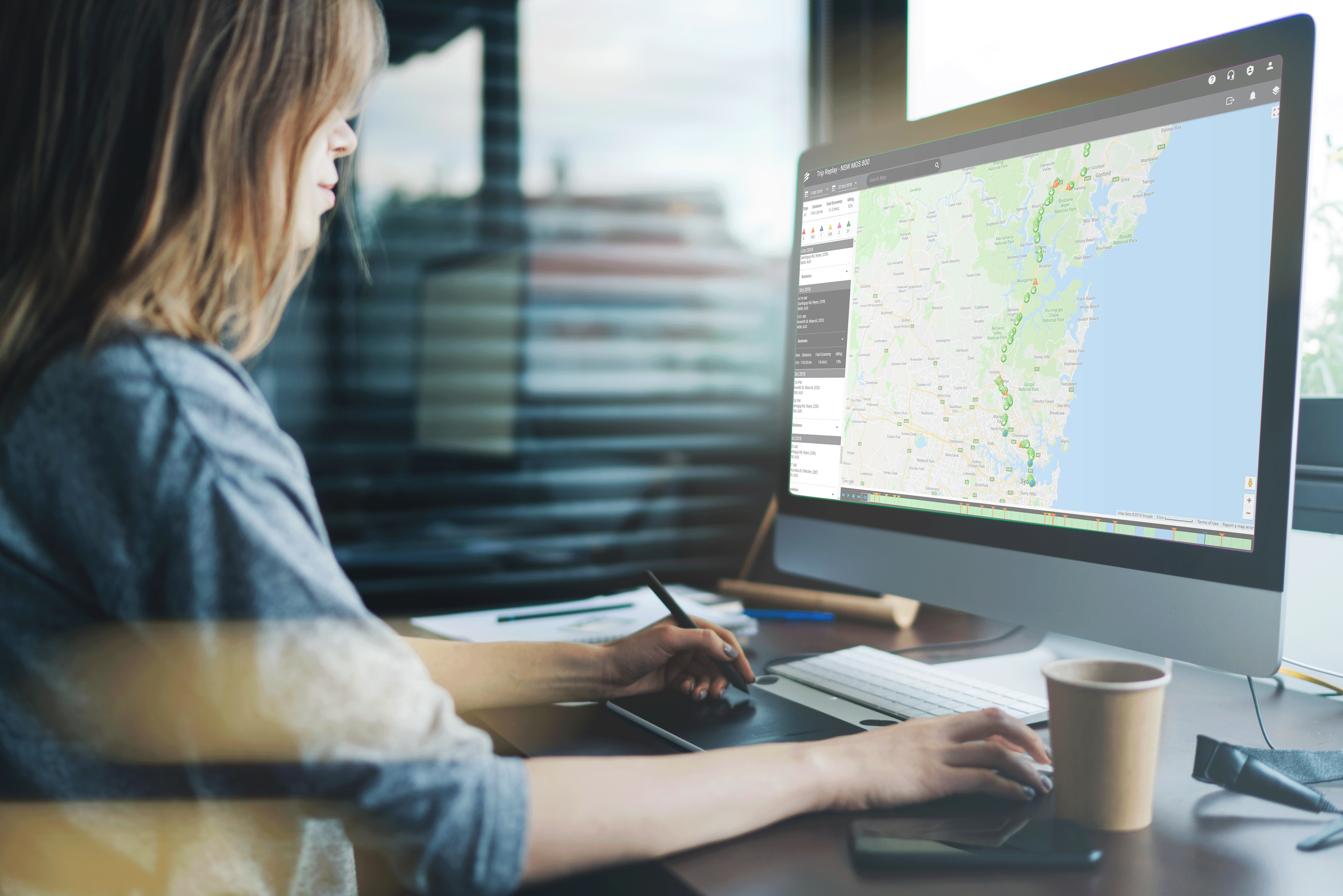

An invaluable way to simplify your FTC claims is to leverage GPS tracking devices that can automate your calculations.

Leverage Devices That Automate FTC Calculations

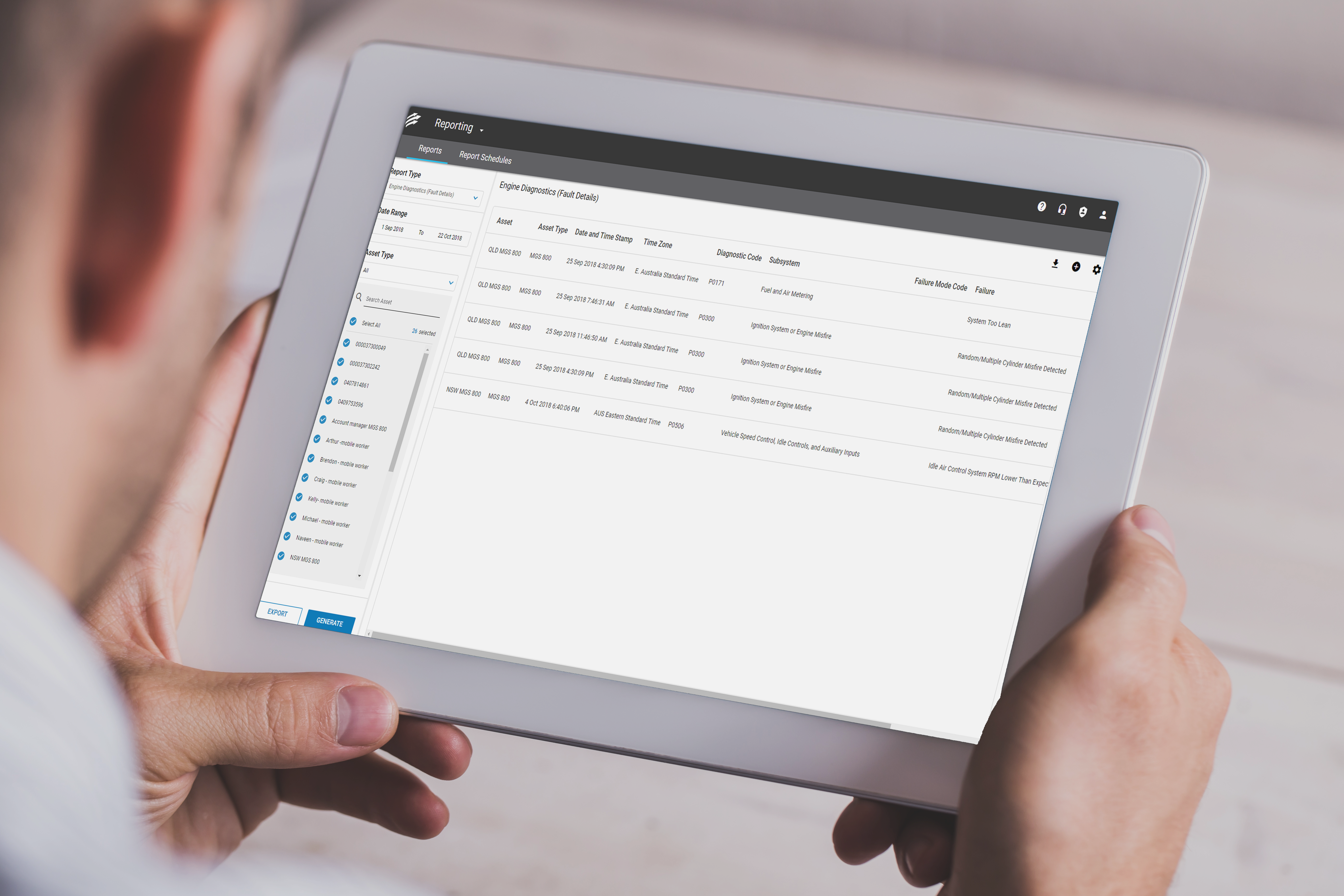

Manually calculating your FTC and keeping accurate records to ensure that every FTC is accounted for can be extremely difficult, especially if you’re running a large fleet. With Fleet Complete, you can automate your FTC claims.

Fleet Complete’s FTC Calculation Service (powered by Prism), produces the most accurate fuel calculations available. It calculates fuel consumption for vehicle operation on both public and private property using real-time GPS data.

Advanced analytics uses geospatial information to determine the exact operation time and fuel consumption of a fleet. This way, you gain detailed automated reports that clearly explain the process, methodology and calculations behind the numbers. Overall, leveraging a GPS fleet tracking device will give you greater security and peace of mind, especially in the event of an audit.

Claiming your fuel tax credits can be confusing, complicated and frustrating, especially if the ATO changes the rates. Before you start calculating your fuel tax, make sure you answer the questions above, including whether your business is eligible, your fuels are eligible and you’re doing eligible activities. To simplify your FTC calculations and claims, use a GPS Tracking Device like Fleet Complete. Prism, the system powering Fleet Complete’s FTC Calculation Service, has extensive experience in this field, tracking more than 31,000 vehicles. This equates to over 23,000,000 trips, and 541,000,000 kilometres travelled. If you want to simplify your fuel tax credit claims request a Fleet Complete demo today.

If you enjoyed this article, please share it through your social network.