It can be frustrating and difficult to calculate your fringe benefit tax (FBT) every year. According to Accountants Daily, a simple mistake or omission can easily attract the Australian Taxation Office’s (ATO’s) attention. For example, failing to report an employee’s private use of a company car, undervaluing employee car park benefits, or incorrectly claiming employer exemptions and rebates. If you want to avoid a potential audit and calculate your FBT return faster, smarter, and more accurately, continue reading. We’ve listed 6 ways our FBT app can help you with your FBT returns.

1. Go Paperless

According to the ATO, employers must self-assess the amount of fringe tax benefits they have to pay. This can be tricky when you have to calculate the total taxable value of all the vehicle fringe tax benefits you provide for your employees.

If you’re manually calculating your tax benefit using the standard statutory fraction method, you’ll find that this method generally costs your business more money. Instead of manually keeping track of calculations via paper books, you should look to an electronic logbook. By leveraging technology like Fleet Complete’s electronic logbook, you can automate the car fringe tax benefit calculations and keep track of your operating costs while meeting the necessary ATO requirements.

2. Save Time & Money

It can be extremely laborious making sure that your traditional paper logbooks are up-to-date. Traditional paper logbooks are not only time consuming and complex, but can also contain incorrect data and mathematical errors. Fleet Complete’s electronic logbook can help you reduce liability by providing a simple and convenient way to automate your vehicle’s operating cost tracking. You can also cut down on administrative personnel tasks, which can save you both time and money.

{{cta(‘6ba72363-881b-40d9-8a0a-f87ca923d938′,’justifycenter’)}}

About FBT Electronic Logbook

3. Gain Peace of Mind

Discovering discrepancies in your FBT calculations can be nerve-racking. Although only 2 million Australians receive a call from the ATO every year, if you’re unlucky enough to be one of them, it can send you into a panic.

According to Jotham Liam, the news editor of Accountant Daily, “The ATO has been vocal in its focus on employer-provided motor vehicles and private use associated with it, having noted the failure of some employers to identify or report these fringe benefits or incorrectly apply exemption provisions.”

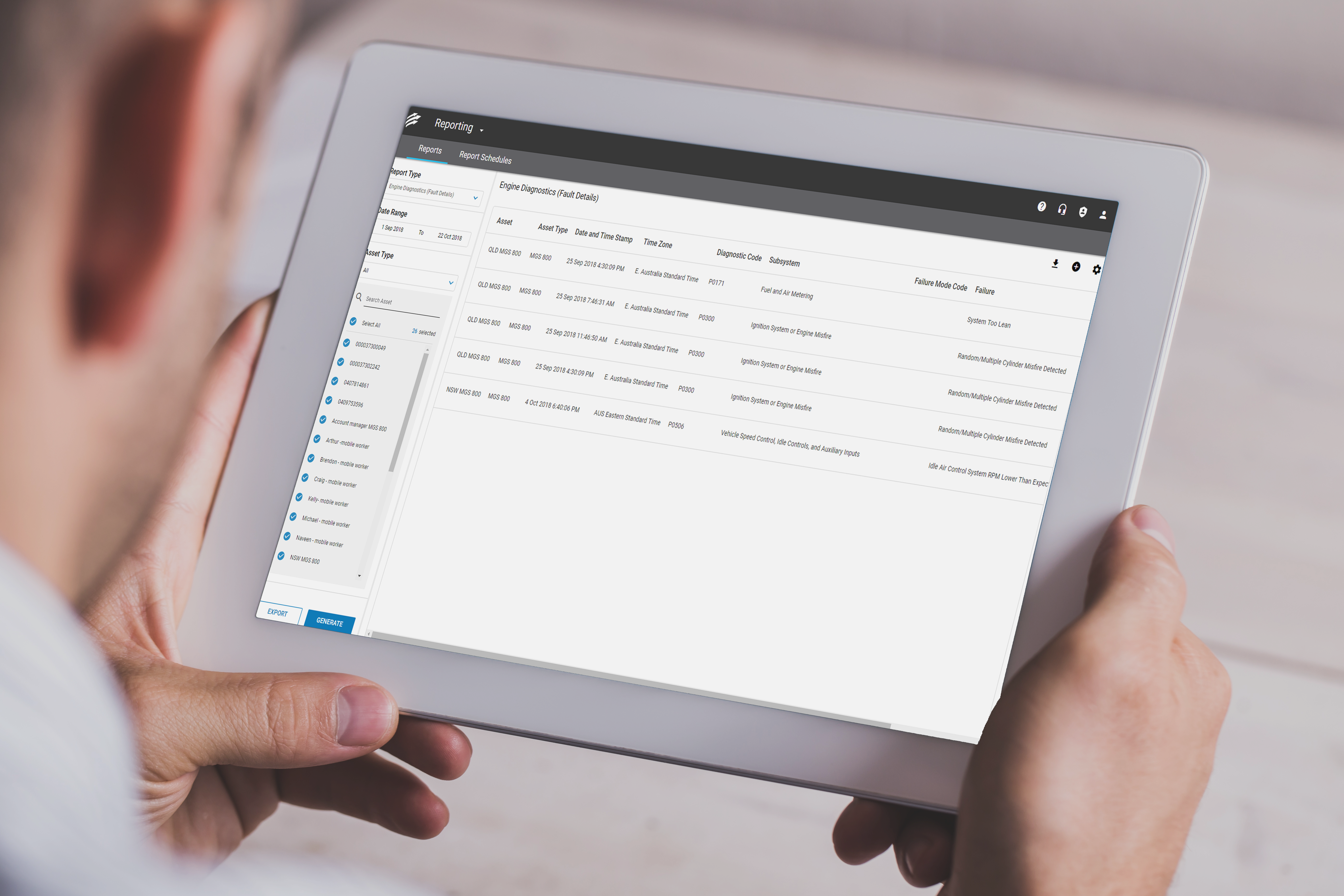

Fleet Complete’s electronic ATO-approved logbook records the date, vehicle’s odometer readings, the purpose of the journey (business or personal) and kilometres travelled for accurate bookkeeping. You’ll also minimise FBT liability if your maximum business use is over a three-month period. This all adds up to assured peace of mind when submitting your FBT claims.

4. Automatic Reporting

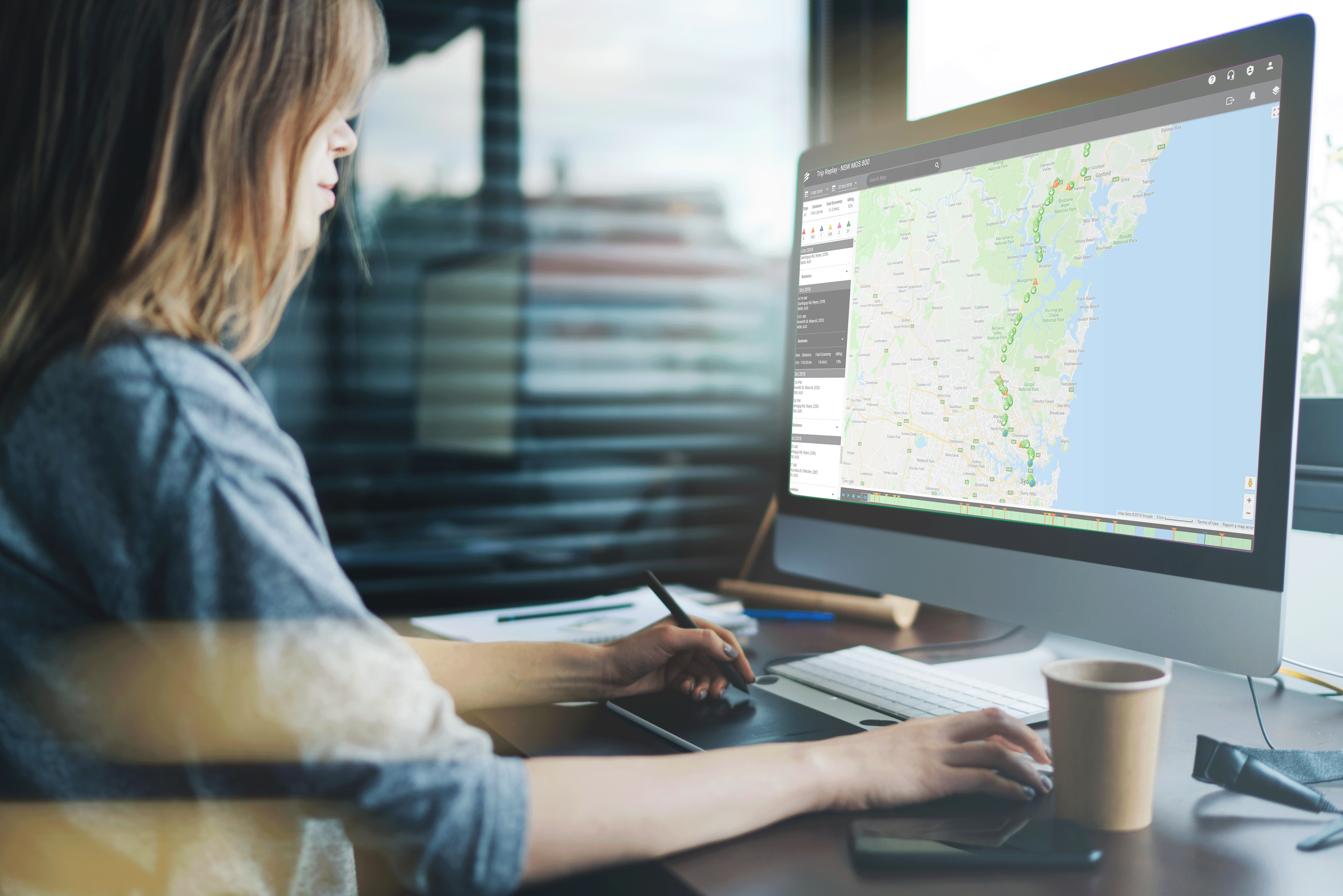

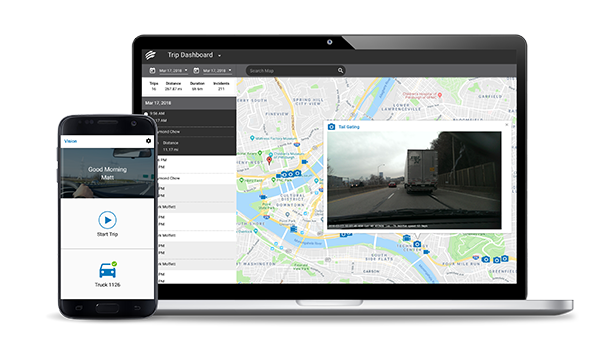

Through the FBT app, drivers can automatically record their odometer data, review each trip and assign the correct information in a few steps. The Fleet Tracker logs trips at the start and end of the odometer reading, as well as the location and number of kilometres travelled. Once a trip is complete, the logs can be stored away and then generated as a report via Fleet Complete’s Software Reports, ready for the ATO.

5. Driver-friendly App

Did you know that the annual accident rate for commercial fleets is around 20%? Fleet drivers drive a significant number of kilometres every year, which increases their risk level.

As a fleet manager or owner, you want to make it easier for your drivers to focus on driving safely and efficiently. Inundating them with additional record-keeping tasks can confuse your drivers, which can lead to missing or incorrect data and mathematical errors. With the FBT mobile app, drivers no longer need to record and tally up their hours manually. All trip details will be automatically recorded. These details can be reviewed and edited via the map function, so all your drivers need to do is focus on the road.

5. Readily Available

If you want assistance with your FBT today, you’ll be happy to know that the FBT Electronic Logbook is currently available on both Google Play and Apple Store and compatible with both Android and Apple devices. All you need to do is to get your drivers to download the app from the app store to get started.

If you’re sick and tired of manually calculating your fringe benefit tax for every employee and totalling this amount every year, it’s time you leveraged technology to automate these tasks. Fleet Complete’s FBT App can help you eliminate the need for paper books, reduce administrative costs, gain peace of mind, simplify driver records and make it easier for your drivers on the road. If you want to simplify your FBT claims today, request our Fleet Complete demo.