If your business operates a fleet of vehicles, it’s time to prepare for your annual Fringe Benefit Tax (FBT) filing. Avoid the costly statutory fraction method with Fleet Complete’s Electronic Logbook, designed to automate and meet Australian Tax Office (ATO) requirements. According to Accountants Daily, a single mistake or omission can easily attract the ATO’s attention. Common errors include failing to report an employee’s private use of a company car, undervaluing employee car park benefits, and incorrectly claiming employer exemptions and rebates. Therefore, being smarter, faster, and more accurate with your FBT reporting is crucial.

Reduce Costs and Complexity with E-Logbooks

Eliminate the tedious upkeep of paper logbooks to make accurate FBT claims and reduce liability. Our Electronic Logbook solution provides a simple and convenient way to automate your vehicle operating cost tracking and minimise your fringe benefits expense. Make paper logs a thing of the past!

Guaranteed to ATO Requirements

Fleet Complete’s Electronic Logbook is fully complaint with all ATO reporting requirements, enabling you to maximise your FBT return. Our ATO-approved solution return. Our ATO-approved solution records the date, vehicle’s odometer readings, kilometres travelled, and purpose of the journey (business vs. personal) for accurate recordkeeping. Significantly reduce your administration costs and minimise FBT liability by clearly establishing maximum business use over a three-month period.

How it Works

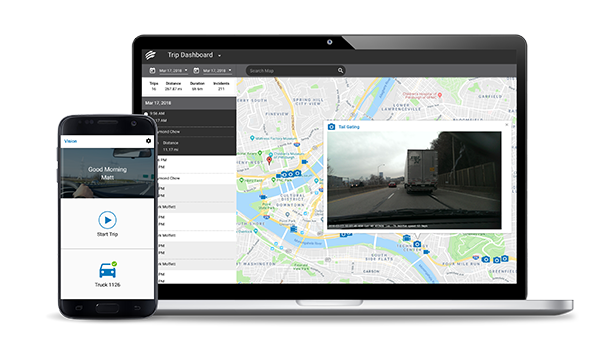

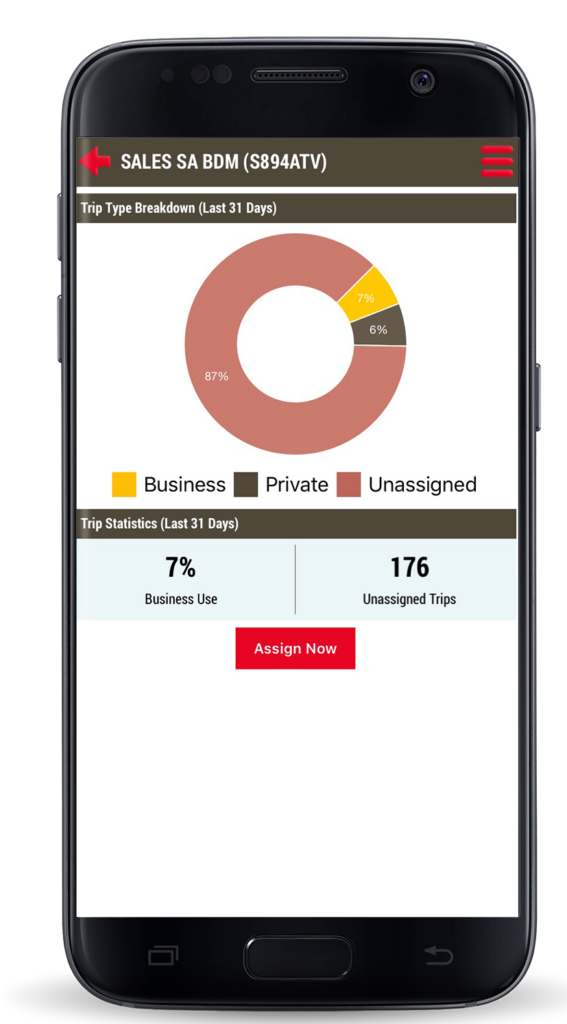

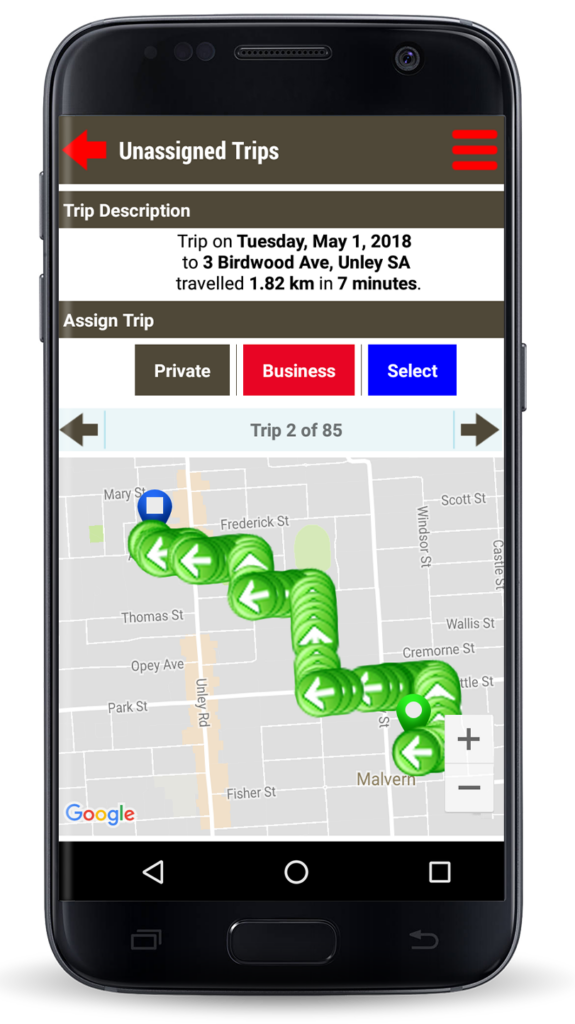

Our Electronic Logbook solution includes a vehicle-tracking device that automatically records odometer data and a mobile application, allowing drivers to review each trip and assign the correct information in a few easy steps. Once completed, all trip logs are stored and ready for ATO reporting, generated in our software reports.

| Fleet Tracker Logs trip start/end odometer readings as well as location/kms. | Electronic Logbook App Records trip purpose and differentiates between business and personal use. | Software Reports Ensures ATO requirements are met for accurate FBT reporting. |

Ease of use for drivers

As a fleet manager or owner, you want to make it easier for your drivers to focus on driving safely and efficiently. Burdening them with additional record-keeping tasks can lead to confusion, missing or incorrect data, and mathematical errors. With the FBT mobile app, drivers no longer need to manually record and tally their hours. All trip details are automatically recorded and can be reviewed and edited via the map function, allowing drivers to focus on the road.

The FBT Electronic Logbook is compatible with both Android and Apple devices.

If you’re tired of manually calculating your fringe benefit tax for every employee and totaling this amount every year, it’s time to leverage technology to automate these tasks. Fleet Complete’s FBT App can help you eliminate the need for paper books, reduce administrative costs, gain peace of mind, simplify driver records, and make it easier for your drivers on the road. Simplify your FBT claims today by requesting our Fleet Complete demo.