Saving lives on the road while cutting costs for fleet operators

If you’ve ever been behind the wheel, you know that driving can be dangerous. In 2023, there were more than 1,200 deaths on Australian roads, with about one in ten involving heavy or fleet vehicles, which are tragic losses for the families and friends of those involved. Additionally, these incidents impose significant costs on businesses through legal claims or rising insurance premiums for fleets.

Insurance costs have risen sharply in recent years due to high collision losses and increased repair costs from automotive part supply chain difficulties. Choosing an insurance product also takes longer, adding costs for fleet managers.

A new insurance product, powered by telematics, offers an easy way for fleet managers to save significantly.

Beyond cost management, businesses must ensure the safety of their drivers, as vehicles are legally deemed workplaces. Telematics data helps businesses secure fairer premiums while ensuring road safety for their drivers.

Insurance Premiums

Fleet underwriting is complex, considering vehicle specifications, usage patterns, driver history, and collision frequencies. Fleets with higher perceived risk incur higher premiums, often paying more than they should due to outdated or inconsistent data that doesn’t reflect recent improvements.

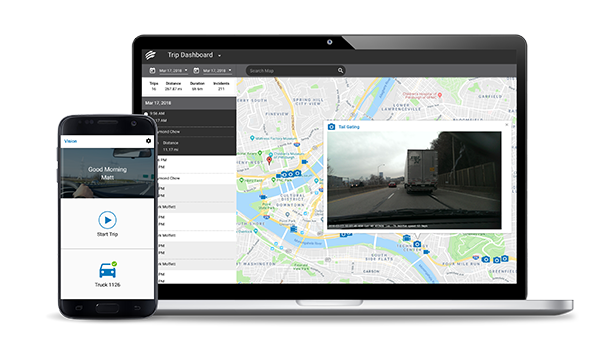

Fleet Complete telematics data offers live tracking and monitoring of vehicle health, location, and driver behaviour, providing an accurate and up-to-date picture of fleet operations. This information enables insurance providers to evaluate risks more accurately.

These tools can also help keep drivers safe. Unfortunately, 15% of drivers cause 50% of at-fault accidents. Telematics can identify drivers more likely to get into collisions, allowing fleet managers to offer training and reduce collision risks. These tools can also be used for vehicle maintenance scheduling.

The best insurance claim is the one you never need to make!

Fleet Complete’s Partnership with Fuse

Fleet Complete’s partnership with Fuse Fleet uses AI-driven solutions to convert Fleet Complete’s data into crash probability reports and offer recommendations on how to improve safety, implement the correct training and prevent crashes. This almost immediately lowers premiums for businesses that encourage safe practices. By identifying and retraining drivers most likely to get into collisions, fleet managers can improve road safety and continue lowering premiums over time. Fuse also enables better, faster, and more cost-efficient claims with its fully digital claims management solutions.

How does it work?

As soon as a trip starts, the AI collects and analyses per-second driving data and compares patterns in behaviour against a database of over 7 billion previous trips. These trips have been trained with real claims, enabling Fuse to rapidly determine a driver’s crash probability. This approach allows us to price insurance premiums more accurately and provide your fleet with valuable insights to improve safety.

Why Fuse?

Fuse has over 30 years of experience in motor fleets and risk advisory services. They are one of Australia’s only providers of behaviour-based insurance with claims management solutions.

To get started, all you need is GPS data, which can be accessed through an API connection. Get in touch with us now to find a telematics solution that meets your needs and will help you slash your fleet’s insurance premiums.